When Life Gives You Things To Protect, Choose Lemonade.

Raven Baxter from the famous American sitcom That’s So Raven could see glimpses of the future and tried to prevent mishaps. But we, who aren’t a part of that universe, must endure what life throws at us. You get up from your desk at the library to quickly grab a book and return to find your laptop gone. You look away from the frying pan for a second, and your kitchen’s on fire. So, unless you can see the future or deflect every mishap that comes your way, it’d be wise to get your stuff covered by renters insurance.

Many may see renters insurance as a rabbit hole they’d rather not fall into, but rest assured that it’s not as complex as one may think.

So, if you’re wondering, “Should I get renters insurance?” The answer is yes. But if you are still on the fence, here are a few things that may help you decide.

In This Article

It’s A Real Bargain

Rent, electricity, maintenance, groceries—the list of monthly expenses is endless, and the last thing you want is to add to it. However, renters insurance has gotten a lot more affordable, thanks to Lemonade. With an investment of as little as $5 a month, you can save yourself from spending a fortune in the future.

Your Landlord’s Insurance Can’t Save Your Stuff

When you move into a rented space, your landlord is not responsible for what happens to your personal belongings. From your faded tee to your smart TV, you won’t get any coverage without renters insurance if you lose something.

Extra Coverage For Your Extra Precious Possessions

With Lemonade, you can add extra coverage to your valuables like jewelry, camera, or refrigerator. Besides the usual terms, this feature provides additional benefits and protection—all for just a few extra bucks.

Why Should You Choose Lemonade?

In an industry flooded with renters insurance policies, what makes Lemonade stand out?

Let’s take a look.

It’s Better Than Traditional Insurance

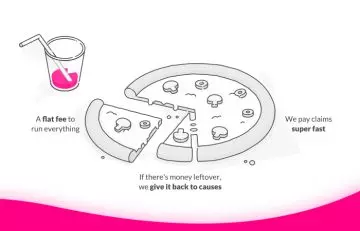

Traditional insurance companies usually gain profits from the amount left after paying claims. This lack of transparency may create discord between the company and its customers. Lemonade isn’t one of them. Instead, Lemonade collects only a flat fee from your premium payments. After paying out claims, it donates the excess amount to charities.

In addition, you can bid farewell to hours of paperwork because Lemonade is a tech-first insurer. It provides an insurance experience that customers can easily understand and manage with the handy Lemonade app.

It’s Super Fast And Easy To Use

From giving you a quote to approving your claims, Lemonade provides a smooth experience from start to finish. It uses its lovely bot, Maya, to activate your policy and get you covered in as little as 90 seconds.

What’s more? You can get your claims paid in no time. Just tell them what happened in a video, and done—seamless digital customer service right here.

It’s Flexible

Lemonade lets you cover what you need. You don’t have to go all in if you don’t want to. It’s an insurance that fits your lifestyle. You make the choices, and it gets you covered.

It Has Your Back

Whether your stuff got damaged or stolen, Lemonade listens to your concerns and approves your claims. When accidents happen, it doesn’t make you fill page after page to get your claim approved. It gets the job done hassle-free.

It’s Pocket-Friendly

Lemonade has super competitive prices. Additionally, you get great discounts for bundling and installing protective devices. You can also save a few bucks if you pay your premium in full annually instead of making monthly payments.

You Get Insurance And Get To Support The Causes You Care About

Lemonade is a public benefit corporation. It takes a flat fee upfront before paying claims and then donates what’s left to meaningful causes you choose. Whether you want to support the Malala Fund or prefer your proceeds to go to March For Our Lives, Lemonade honors your wish. With Lemonade, you get the insurance that makes the world a better place.

After all, it’s not for nothing that it has 11 awards and rankings, including Best Renters Insurance Overall by Business Insider and a whopping 5-star rating by Forbes.

What Does Lemonade’s Renters Insurance Include?

Lemonade’s renters policy includes different types of coverage:

- Personal Property: This can cover your stuff against damages caused by vandalism, fire, theft, windstorm, explosions, and other perils.

- Loss Of Use: If your home is uninhabitable due to certain circumstances, it will help cover the costs of alternative accommodations.

- Liability Coverage: This is activated when you cause bodily injury or property damage to other people.

Medical Payments: It helps pay for your medical bills, usually under $5000, in case you’re a victim or if your guests sustain injuries while at your place.

When signing up for a policy with Lemonade, you can choose different coverage limits. If you change your mind later, you can revisit and change your preferences from the Lemonade app.

Renters insurance would hardly be this easy, quick, and delightful had it not been for Lemonade, the only insurance company that’s a certified B corp.

So, the next time you rap along to Suga’s famous lines, “I got a big house, big cars, big rings,” pause for a moment and ask yourself, “Do I have a renters insurance policy for them?”